Federal Reserve News: Today's Decision — Charting the Future for Innovation and Growth

The Fed's About-Face: Are We Headed for a December Miracle?

Okay, folks, buckle up, because things are getting really interesting in the world of finance. We're seeing a dramatic shift, a near-180, in expectations around the Federal Reserve's next move on interest rates. And honestly, the speed of this reversal is breathtaking.

Remember just last week? Wall Street seemed convinced that a December rate cut was off the table—gone, kaput! The CME FedWatch Tool put the probability at a measly 30%. Fast forward to today, and suddenly, we're staring at an almost certain rate cut, with futures markets pricing in an 85% chance! That, my friends, is a seismic shift in sentiment.

What's driving this? Well, a few things. First, we're hearing dovish noises from key Fed officials. New York Fed President John Williams and San Francisco Fed President Mary Daley are both hinting at "room for a further adjustment in the near term." Now, I know what you might be thinking: Fed speak can be cryptic, but the message seems pretty darn clear. Suddenly, the Fed interest rate cut in December looks like it is very much back on the table - Fortune

Hope on the Horizon?

But what does this all mean, beyond the jargon and the market fluctuations? Imagine this rate cut as a pressure release valve for the economy. We’re talking about potentially easing the burden on homeowners, credit card users, and anyone with a loan. It could mean making it cheaper to refinance, injecting some much-needed oxygen into the economic bloodstream.

Of course, there's always a risk. Inflation has been stubbornly persistent, hovering a full percentage point above the Fed’s 2% target. A rate cut could fuel those inflationary pressures, but the Fed seems to be betting that the risk of slowing growth and rising unemployment is the greater threat. The unemployment rate ticking up to 4.4% in September—the highest since October 2021—is undoubtedly raising eyebrows.

And it isn't just the experts who are hopeful. The market's reaction speaks volumes. Nasdaq 100 and S&P 500 futures are up, reflecting investor optimism about a potential rate cut. This is the kind of news that fuels asset markets and lifts spirits.

Remember the sell-off we saw the previous week, with the S&P 500 losing 2%? This reversal is a powerful reminder of how quickly things can change in the world of finance, and how much influence the Fed wields. This is the kind of whipsaw that makes your head spin, but it also underscores the dynamic nature of the economy.

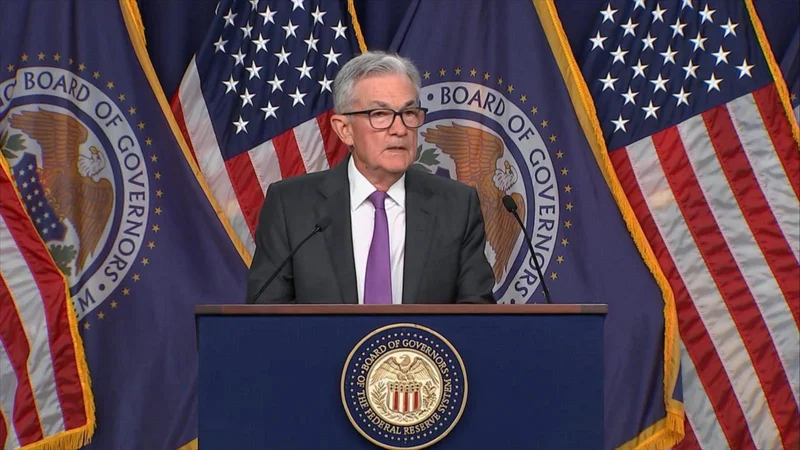

And speaking of influence, let's not forget about Jerome Powell. Speculators are putting the probability of him delivering a rate cut at over 75%. If he does, it would be a bold move, especially given the recent inflation data. But Powell has shown a willingness to adapt to changing circumstances, and this could be another example of his flexibility.

But what if he doesn't? That's the question that keeps me up at night. What if the Fed hesitates, worried about inflation? The markets could react negatively, and we could see a renewed sell-off. It's a gamble, no doubt, but one that the Fed seems increasingly willing to take.

It’s also a reminder of the Fed’s dual mandate: to keep inflation under control and maximize employment. Balancing these two goals is a constant tightrope walk, and the Fed's decision will have far-reaching consequences for the economy.

It is also interesting to note that John Williams has always voted with the majority and has never taken an opposing view to the Chair since 2011. Does this signal that the Fed is, in fact, in lockstep?

A Glimmer of Hope in the Economic Forecast

So, what's the real takeaway here? The Fed's potential rate cut is a bold move that could provide a much-needed boost to the economy. While risks remain, the potential rewards are significant. It's a decision that could impact everything from mortgage rates to job growth, and it's one that we'll be watching closely in the weeks ahead. This is the kind of news that reminds me why I got into this field in the first place: the potential to shape a better future for everyone.