Mortgage Rates Today: What the Data Says for 30-Year & Refinance

Rates Down, But Don't Break Out the Bubbly Yet

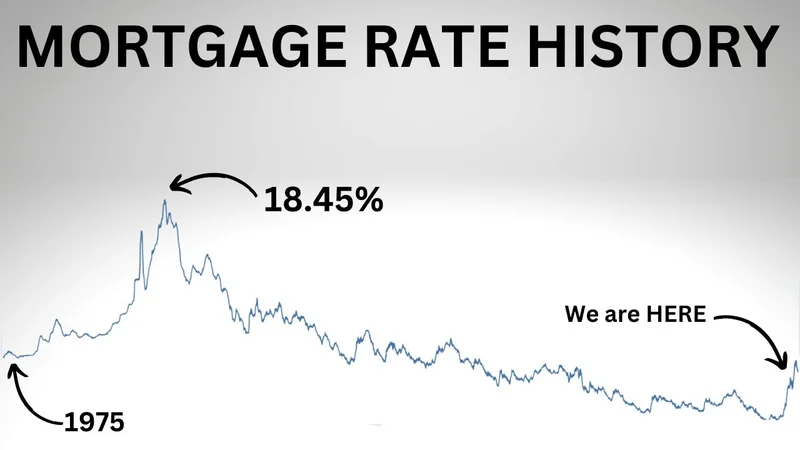

Mortgage rates have dipped slightly. Freddie Mac reports an average of 6.23% for a 30-year fixed-rate mortgage (FRM) as of November 26, 2025. Zillow's data shows a slightly more optimistic 6.04%. A decrease, yes, but let’s not pretend this is a return to the sub-3% days of early 2021. Those were an anomaly, not the norm.

The Illusion of Improvement

The headlines are screaming "rates are down!" But let's look closer. A decrease from, say, 6.5% to 6.23% on a $400,000 mortgage translates to a monthly savings of roughly $65. Is that something? Sure. Is it enough to suddenly make homes affordable for the millions priced out? Absolutely not. It's like putting a band-aid on a gaping wound.

And while pending home sales are supposedly at their highest level since last November, we need to ask: Compared to what? Last November wasn't exactly a banner year for real estate. This slight uptick could just be a seasonal blip, or a desperate scramble from buyers who’ve been waiting on the sidelines, fearing rates will climb even higher.

The real question is: are these "buyers" actually closing? Or are they just writing offers in a market where inventory is still constrained? Details on closed transactions would give a clearer picture.

Forecasters and Crystal Balls

Fannie Mae and the Mortgage Bankers Association (MBA) are both projecting rates to decline gradually over the next year. Fannie Mae is slightly more optimistic, forecasting 5.9% by Q4 2026, while the MBA sees rates stuck at 6.4%. (That’s quite the discrepancy, isn’t it?) You can read more about the rate drop in "Mortgage Rates Drop Before Thanksgiving | Today, November 26, 2025 - The Mortgage Reports".

These forecasts are based on economic models, but economic models are only as good as the data they're fed. And the economy is about as predictable as a toddler with a box of crayons. Remember August 2025, when President Trump fired the Bureau of Labor Statistics commissioner? That wasn't exactly confidence-inspiring. Political interference can skew the data, making accurate forecasting even harder. I've looked at hundreds of these forecasts, and the level of uncertainty baked into these estimates is higher than usual.

The CNN Business Fear & Greed Index creeping up to 18 out of 100 (from 13) is also telling. It suggests a slight easing of extreme fear, but we're still firmly in "fear" territory. People aren't exactly rushing to buy. And this is the part of the report that I find genuinely puzzling: the disconnect between the slight drop in rates and the persistent anxiety in the market.

Initial jobless claims fell to 216,000 for the week ending Nov. 22. A positive sign. Durable goods orders grew to $313.7 billion in September. Another positive. But these are just snapshots. We need to see sustained improvement over several months, not just a week or two, to declare any real victory. It’s like judging a marathon runner by their pace at mile two.

Is This a False Dawn?

Look, a small dip in mortgage rates is better than a spike. Nobody's arguing that. But let's not pretend this is the cavalry arriving to rescue the housing market. We're still facing high prices, economic uncertainty, and a general sense of unease. The slight decrease is more like a mirage in the desert – it might look promising from a distance, but it won't quench your thirst.

A Glimmer of Hope, or Just Smoke and Mirrors?

The data paints a picture of cautious optimism, but the underlying fundamentals haven't shifted dramatically. We're still in a high-rate environment, and a few basis points shaved off the top isn't going to magically solve the affordability crisis. Investors need to be wary of the headlines and focus on the long-term trends. The market may be showing signs of life, but it's far too early to declare it healthy.