VIX: What it is, its current levels, and why the market is misreading it.

Generated Title: VIX Jumps? Or Just a Dead Cat Bounce? The Data Tells a Different Story

Decoding the VIX Spike

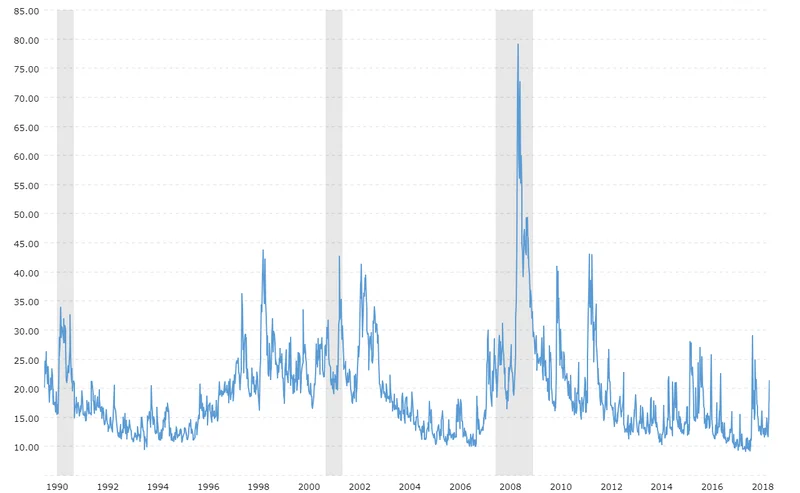

The Cboe Volatility Index, or VIX, has been making headlines recently, with some outlets screaming about levels not seen since Trump's "Liberation Day" tariffs back in April (which, let's be honest, sounds like a bad sci-fi movie plot). The VIX, for the uninitiated, is Wall Street's so-called "fear gauge," measuring expected volatility in S&P 500 options. A jump in the VIX usually sends shivers down spines, suggesting investors are running for cover.

But before we all start hoarding canned goods and burying gold in the backyard, let’s take a look at the actual numbers. Yes, the VIX did spike, reaching 27.8 on Thursday before settling around 26.3. That's a 50% jump in November alone. However, context is everything. The The stock market’s ‘fear gauge’ spiked to its highest level since Trump’s ‘Liberation Day’ tariffs caused a global selloff article notes that readings above 20 signal heightened anxiety, and above 40, a crisis. We’re not at crisis levels. Not even close.

The recent spike, according to reports, is due to a cocktail of concerns: overvalued tech stocks (Nvidia's earnings notwithstanding), a potentially less dovish Federal Reserve, and escalating geopolitical tensions. Sounds scary, right? But let’s break this down. The article mentions Nvidia's blockbuster earnings couldn't calm nerves. But another article notes that the S&P 500 Index is only off by -0.19% and the Dow Jones Industrials Index is down by -0.21%. Doesn't exactly scream "panic" to me.

The AI Hype vs. Reality

The elephant in the room is, of course, AI. Everyone's worried about an AI valuation bubble. Several firms are trading at price-to-earnings multiples last seen during the dotcom era. And, true, Nvidia's stock has been on a tear. But is it all just hype?

Well, Q3 earnings rose +14.6%, more than doubling expectations of +7.2% y/y. So, some companies are delivering. The real question is whether this growth is sustainable. I've looked at hundreds of these quarterly reports, and this level of outperformance, across the board, is unusual.

And this is the part of the report that I find genuinely puzzling: The market seems to be reacting more to the idea of a bubble than to the actual performance of the underlying companies. I mean, look at Bath & Body Works Inc. (BBWI), down more than -25% after reporting Q3 net sales of $1.59 billion, below the consensus of $1.63 billion. It's a classic case of missing expectations, and the market is punishing them for it. But Nvidia, despite its impressive numbers, is still viewed with suspicion.

What’s the Real Driver?

The other factor is the Federal Reserve. The market is constantly trying to predict the Fed's next move, hanging on every word from Chairman Powell. The CME FedWatch Tool showed the chance of a rate cut at the December 9-10 FOMC meeting rose to 39.6% today from 30.1% on Wednesday, then declined sharply from 50% a week ago and 98.8% a month ago. That’s a lot of back-and-forth (interest rate speculation). It’s enough to make anyone nervous.

But, remember, extreme VIX spikes rarely last. The April tariff crisis saw the VIX drop from above 50 to below 20 in less than 100 days. This is the part everyone seems to forget: markets are resilient. They adapt. They find a new equilibrium. We tend to overreact in the short term and underestimate the long-term adaptability of the market.

Just Noise, Not a Signal

The VIX is a useful tool, but it's not a crystal ball. It's a measure of expected volatility, not a guarantee of impending doom. The current spike seems to be driven by a combination of factors, but none of them, in my opinion, are enough to trigger a full-blown market meltdown. The market will find its footing in the face of tech valuations, interest rates, and geopolitical risks. It always does.